estate tax return due date 1041

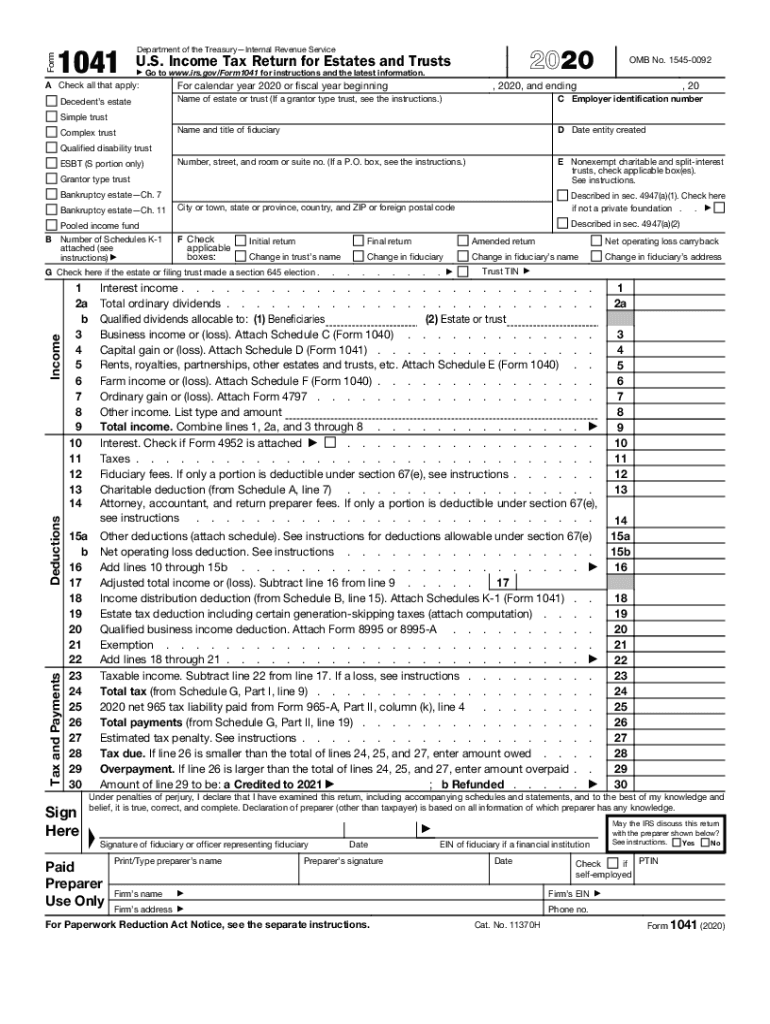

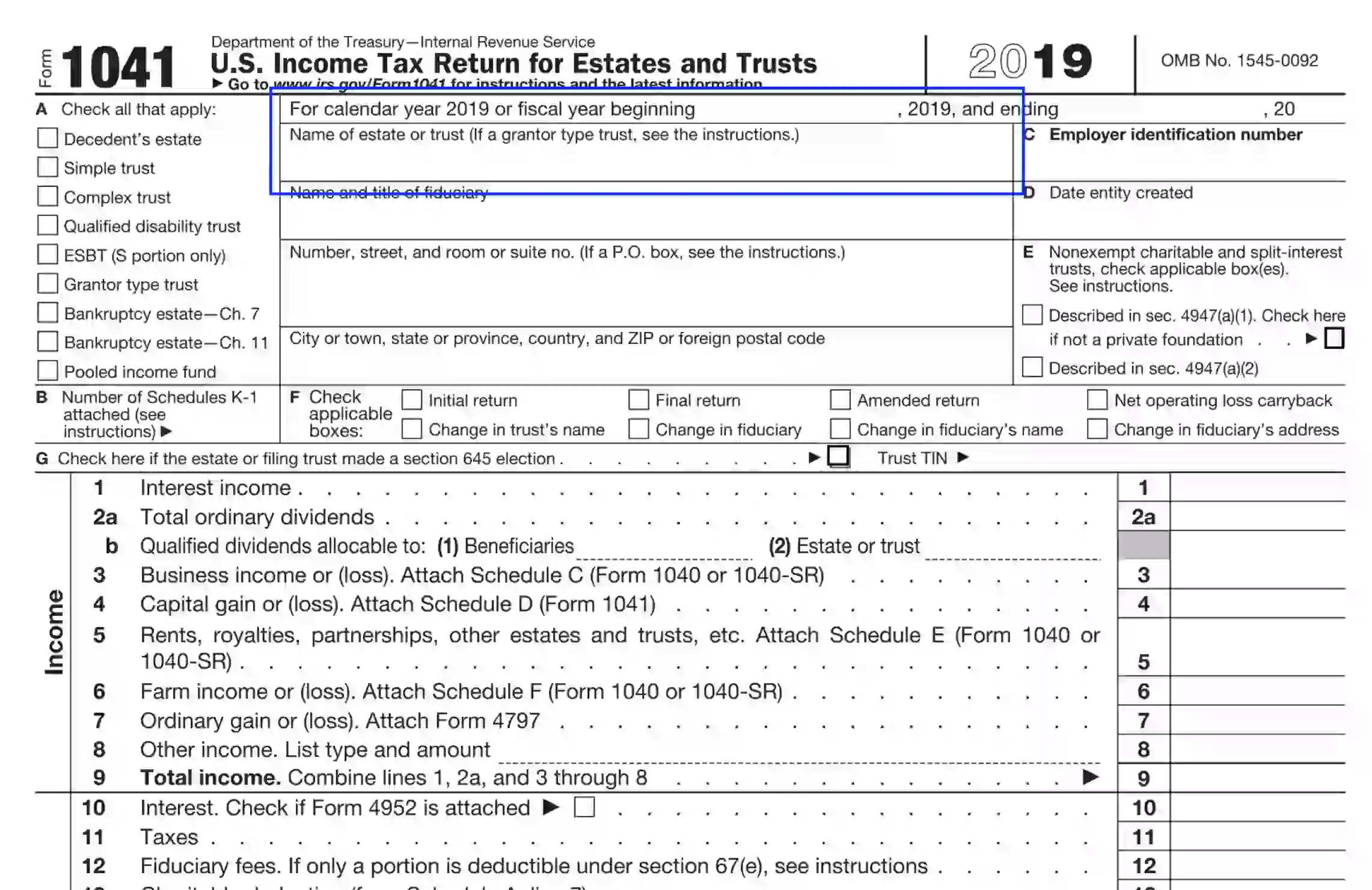

The costs of selling the property is deductible from the amount realized. Form 1041 is an IRS tax return used to record income generated by assets held in an estate or trust.

Calameo Irs Form 7004 Automatic Extension For Business Tax Returns

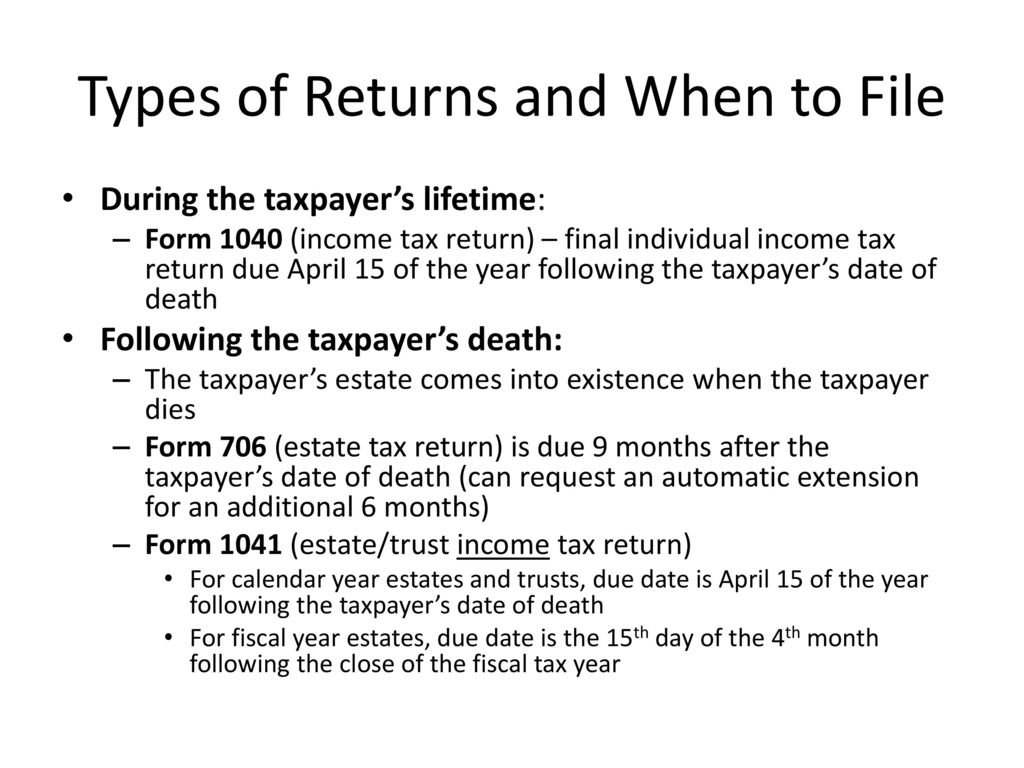

For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041.

. If no federal estate tax return is required for the decedents estate the federal gift tax return due date is April 15th following the year of the decedents death. For calendar-year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 2019. As long as the estate exists a Form 1041 should be filed.

Resulting in a Form 1041 due date of April 15 the. What is the Deadline to file Form 1041. The due date for filing a 1041 falls on tax day.

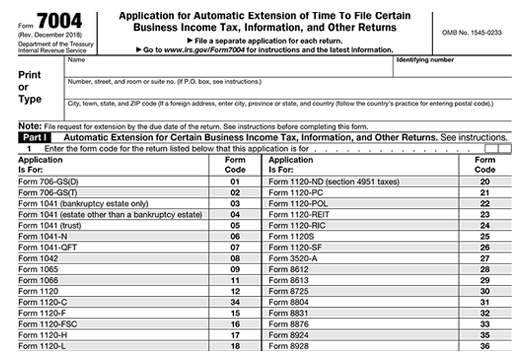

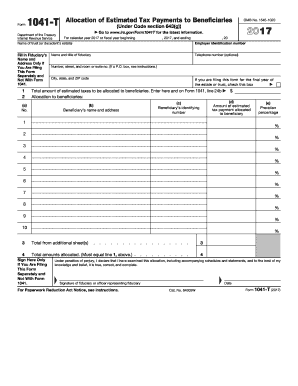

Trusts and estates that need more time to file their 1041 tax return can apply for an extension using IRS Form 7004 to extend their filing deadline up to 6 months. Form 1041 Form 1041-N. For all tax filing deadlines.

Then you would subtract the basis of the property which would be a step-up in basis to fair market value as of the date. If the tax year for an estate ends on June 30 2020you must file by October 15 2020. For fiscal year estates file Form 1041 by the 15th day of the.

The types of taxes a deceased taxpayers estate. The executor trustee or personal representative of the estate or trust is responsible for filing Form 1041. Form 1041 April 15 due date with an extension available until September 30 by filing IRS Form 7004.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Estate and trust income tax payments and return filings on. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return.

Trusts and estates are required to file this form with the IRS four months and 15 days after the close of the tax year. Since this date falls on a holiday this year the deadline for filing Form 1041 is Monday April 18 2022. For trusts operating on a calendar year this is April 15 2022.

13 rows Only about one in twelve estate income tax returns are due on April 15. Read on to learn the specifics Dont File Form 1041 If Form 1041 is not needed if. Form 1041 - Return Due Date.

The late filing penalty is 5 of the tax due for each month or part of a. The changes usually apply to taxation years beginning after. Known due dates at this posting are below for the 2021 tax year due in 2022.

U S Income Tax Return For Estates And Trusts 1041 Youtube

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Form 1041 Fill Out Sign Online Dochub

What Is A Fiduciary Income Tax Return

File Business Tax Extension Online How To File A Business Extension

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

1041 Name Control Guidelines Ef Message 5300 Irs Reject R0000 901 01

All About Irs Form 1041 Smartasset

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

Instructions For Form 1041 U S Income Tax Return For Estates And Tr

Irs Form 1041 Fill Out Printable Pdf Forms Online

1041 T Form Fill Online Printable Fillable Blank Pdffiller

Best Tax Software For Estates And Trusts Form K 1 And 1041

2021 Federal Tax Filing Deadlines 2022 Irs Tax Deadlines 1041 Due Date

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)